WHEDA

More Like Home™

Repair & Renew Loan

Using $50 million to revive Wisconsin's communities—one home at a time.

It's true. There's no place like home.

If your home was built before 1984, there's a good chance it may need repairs. That's why Wisconsin's governing body has committed $50 million to help revive our communities.

With the More Like Home™ Repair and Renew Loan, homeowners will get the repairs needed to renew their living spaces for years to come. Here, our support is more than just monetary—it’s a commitment to helping your house feel more like home. Find a lender and start today.

Loan Requirements

What are the key qualifications?

Applicant

- Must occupy the home as their primary residence

- More Like Home Repair & Renew Household Income Limits

Home

- Must have been constructed at least 40 years prior to the date of the loan application

- Must be one of the following property types: single-family residence, condo, 2-unit, or manufactured

Amount

- May not exceed $50,000

- Determined by the specific repair work needed

- Lower-than-market rate loan

Work

- Used only for qualifying repairs

- Must be completed by a licensed and insured contractor

Frequently Asked Questions

Is this loan forgivable?

The More Like Home™ Repair and Renew Loan dedicated a portion of the $50 million to providing low-income qualified homeowners with a 0% interest, 5-year forgivable loan. These program funds have been exhausted, but a lower-than-market rate loan is still available. Participating lenders will accept applications from qualified borrowers on a first-come, first-served basis until the funds are depleted.

What is the status of the funds for my loan?

Any More Like Home™ Repair and Renew Loan approved and rate-locked by a participating lender has reserved funds. Please continue to work with your lender and contractor to complete your repairs.

How do I learn more about the lower-than-market rate loan?

Participating lenders are taking applications for low-interest loans to qualified borrowers on a first-come, first-served basis until the funds are depleted. Contact a lender for more information.

What repairs qualify?

Repairing or replacing key structural areas

- Roof

- Windows

- Exterior doors

- Heating, electrical, or plumbing systems

What safety improvements qualify?

Removal of environmental contaminants

- Lead paint

- Asbestos

- Mold

- Other internal environmental contamination

Eligibility Quiz

Let's check your home's eligibility.

Is the home located in Wisconsin?

Is the home at least 40 years old?

What type of home is it?

How do you use the home?

Choose One

Please select one of the options above.

Only homes located in Wisconsin qualify for a More Like Home Loan.

Chose One

Please select one of the options above.

The house must be older than 40 years old.

Chose One

Please select one of the options above.

Only single-family residence, manufactured, condo, and 2-unit homes qualify for a More Like Home Loan.

Chose One

It looks like your home may qualify for a More Like Home Loan!

Financing is available until the entire $50 million has been distributed.

Please select one of the options above.

Only homes used as a primary residence qualify for a More Like Home Loan.

This quiz doesn't guarantee loan approval.

Find a lender

This list will be updated as more lenders are added to the program.

Financing is available until the entire $50 million has been distributed.

CoVantage Credit Union

Statewide coverage.

GECU- Government Employee Credit Union

Branch location: La Crosse

Must live in or work in La Crosse County or any government employee within a 60-mile radius of the branch.

Mound City Bank

Service area includes counties of Grant, Iowa, Lafayette, Dane and Green counties.

Branch locations: Platteville, Mt Horeb, Mineral Point, Belmont and Cuba City

Simplicity Credit Union

Service area includes counties of Adams, Brown, Calumet, Chippewa, Clark, Eau Claire, Fond du Lac, Jackson, Marathon, Outagamie, Portage, Shawano, Taylor, Trempealeau, Waupaca, Waushara, Winnebago, and Wood.

Branch locations: Stevens Point, Marshfield, Neillsville, and Neenah.

Tri City National Bank

Service area includes counties of Milwaukee, Racine, Kenosha, Waukesha, Ozaukee, Washington, and Walworth.

United One Credit Union

Service area includes counties of Manitowoc, Sheboygan, Kewaunee, and Door.

Visit website for all branch locations.

Churchill Mortgage

Not currently accepting new applications.

North Shore Bank

Currently not taking new applications as of 10/25/24

Service area includes counties of Milwaukee, Waukesha, Ozaukee, Brown, Door, Racine, Kenosha, Washington.

Visit website for all branch locations.

Royal Bank

Currently not taking new applications as of 11/12/2024

Service area includes all counties where a branch location is listed.

Branch locations: Adams, Avoca, Camp Douglas, Cassville, Cazenovia, Cobb, Dickeyville, Elroy, Endeavor, Gays Mills, Hillsboro, Lancaster, La Valle, Lone Rock, Mauston, New Lisbon, Oxford, Prairie du Chien, Richland Center, Spring Green, Viroqua.

Finding the right contractor

Knowing that a qualified and reliable contractor is handling your home repairs makes a difference. A licensed and insured contractor follows building codes and regulations–increasing the safety of your home and ensuring the longevity of the repairs.

Connect with a licensed and insured contractor in your area for peace of mind and expert results.

- Ask for recommendations from your community and professional organizations

- Find a Wisconsin licensed and insured contractor

- Request more than one detailed estimate in writing

- Have clear expectations around cost, timelines, and safety requirements

Benefits of a Renewed Space

Ready to rest easy?

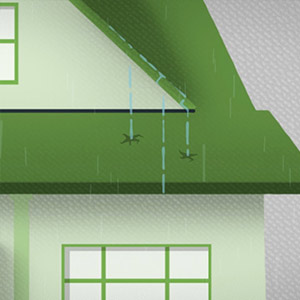

Avoid insurance loss by restoring your roof.

Protect your home's structural integrity and prevent insurance complications with a well-maintained roof.

Repairing a roof reduces your energy costs and increases your property value.

Age gracefully in a more familiar place–home.

Aging in place offers significant health and emotional benefits by maintaining comfort, familiarity, autonomy, and quality of life.

Improve safety and quality with the More Like Home™ Repair & Renew Loan.

Let go of worries and enjoy peace of mind.

Transform the functionality of your home by repairing or replacing your heating, electrical, or plumbing systems.

Energy-efficient improvements lower monthly utility costs–giving you one less thing to stress about.